How to Set Up Payroll in Odoo HRMS?

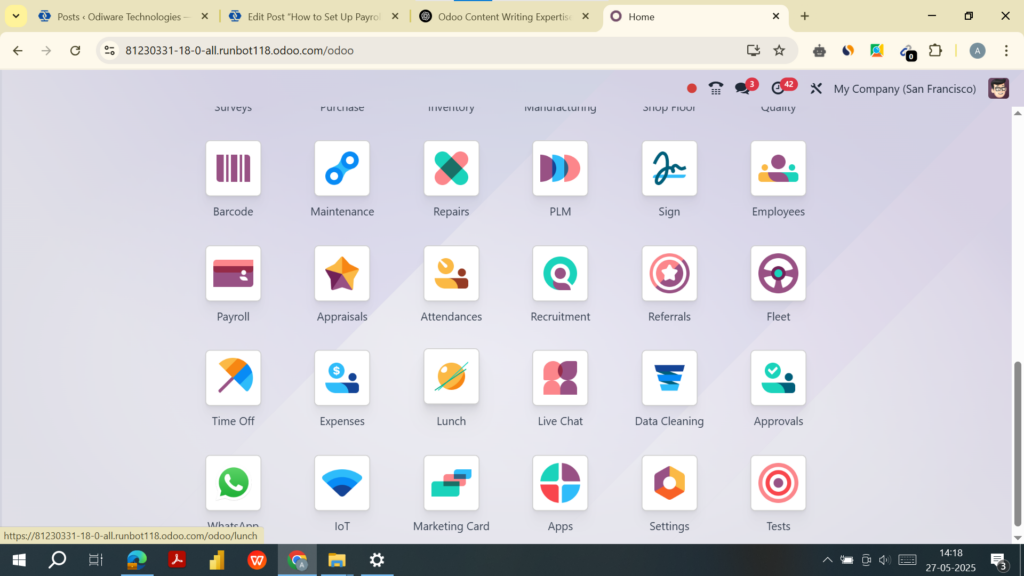

Odoo is an all-in-one business management software that helps organizations streamline their processes, including human resources and payroll management. With its comprehensive HRMS (Human Resource Management System), businesses can efficiently manage employee data, attendance, leaves, appraisals, and payroll. Payroll processing is a crucial function for any organization, ensuring employees receive accurate and timely payments while complying with labor laws and tax regulations.

This guide will provide a step-by-step approach to setting up payroll in Odoo HRMS, covering configuration, employee data setup, salary structure, payslip generation, and compliance aspects.

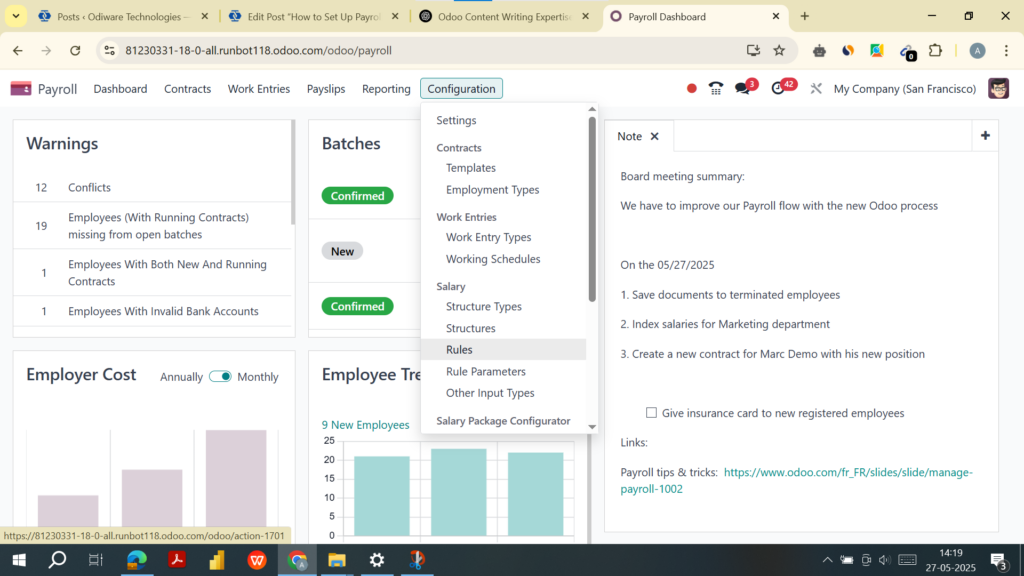

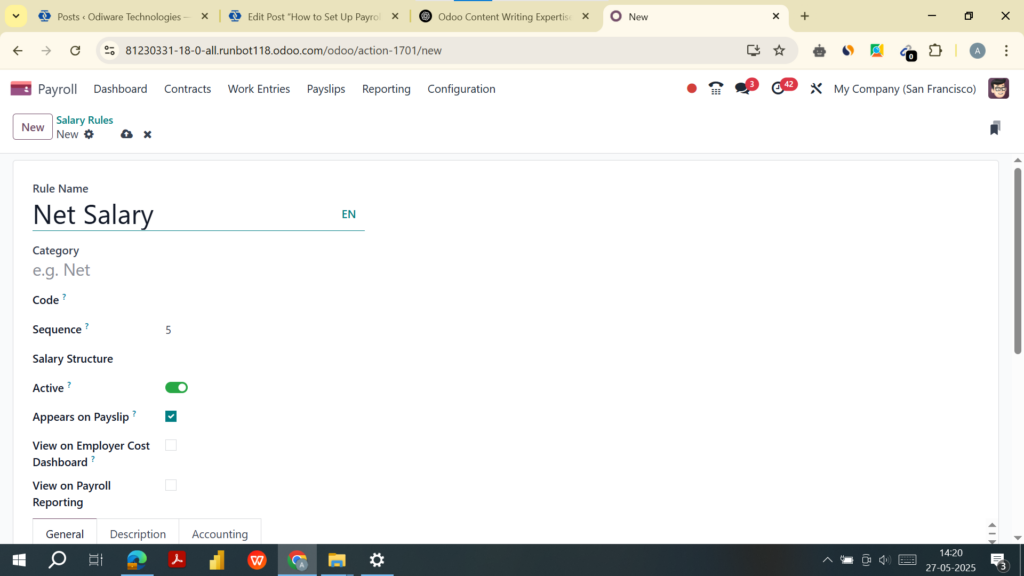

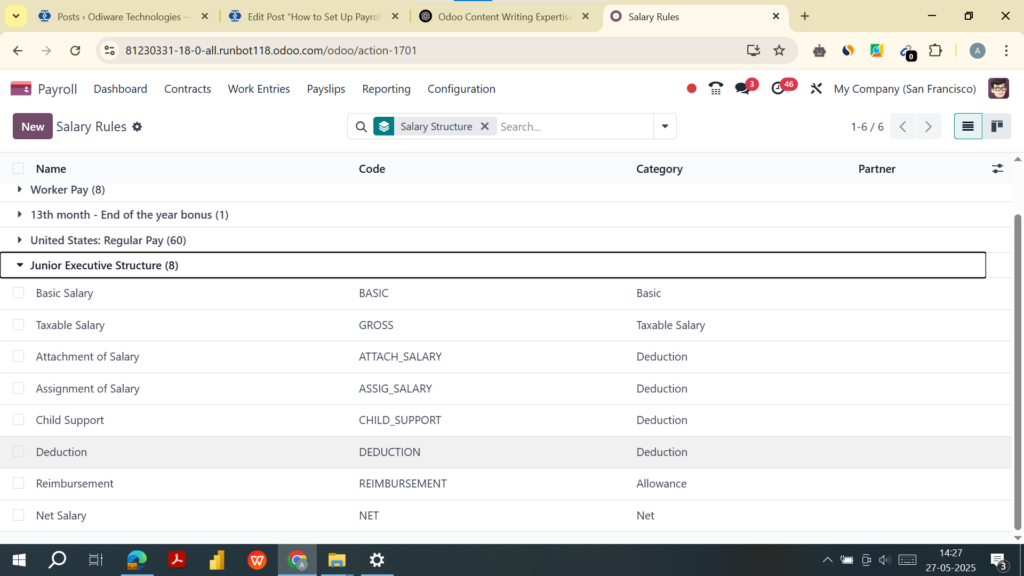

Step 1: Configure Salary Rules

Path: Payroll → Configuration → Salary Rules

- Click Create.

- Enter:

- Name (e.g., Basic Salary, HRA, Provident Fund).

- Category: Assign a logical group (Allowances, Deductions, etc.)

- Code: Use short, unique codes (e.g., BASIC, HRA).

- Computation Type:

- Fixed: For fixed amounts.

- Percentage: Of another component (e.g., 10% of BASIC).

- Python Code: For advanced logic.

- Add conditions (e.g., only applicable to full-time employees).

- Define Accounting Information:

- Debit and Credit accounts if linking to the accounting module.

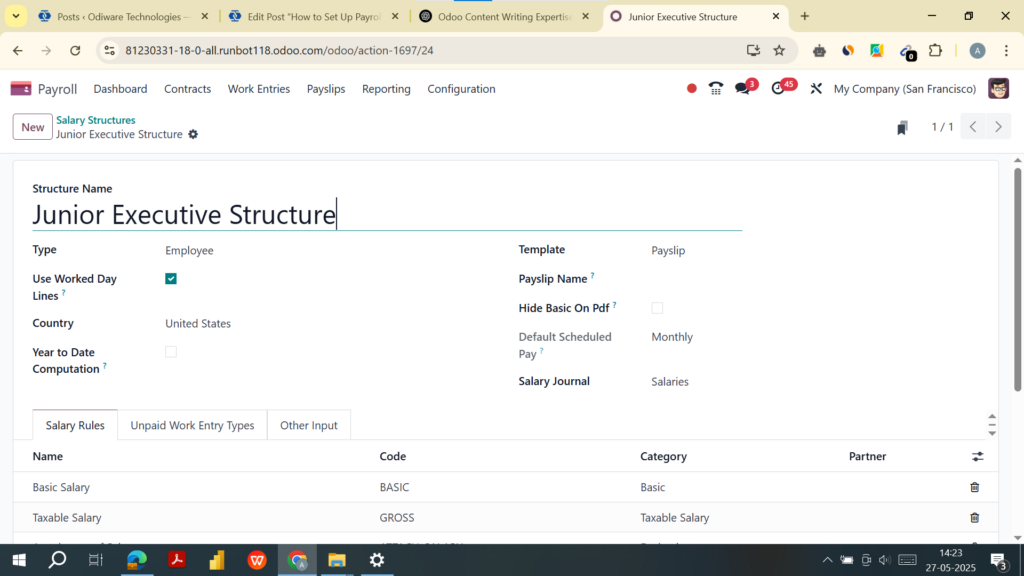

Step 2: Set Up Salary Structures

Path: Payroll → Configuration → Salary Structures

- Click Create.

- Enter:

- Name (e.g., Junior Executive Structure).

- Type: Employee.

- Assign Salary Rules using the “Add a line” button.

- Set Company, Working Schedule, and Structure Type.

- Enable Use Worked Day Lines to integrate with attendance or timesheets.

Step 3: Link Salary Structures to Employee Contracts

Path: Employees → Select Employee → Contracts Tab → Create

- Set up:

- Start Date, End Date (if applicable)

- Wage Type (Monthly, Hourly, etc.)

- Salary Structure (Select from step 3)

- Working Hours (if hourly-based)

- Bank Account Details

- Ensure status is set to Running for payroll to process.

Step 4: Configure Accounting Integration

Path: Payroll → Configuration → Settings

- Check Generate Accounting Entries.

- Enable Analytic Accounting (optional for departmental cost tracking).

- Set a default Payroll Journal (e.g., Payroll Expenses).

You must define journal accounts under:

Payroll → Configuration → Salary Rules → Accountingsection.

This ensures payroll expenses automatically appear in your general ledger.

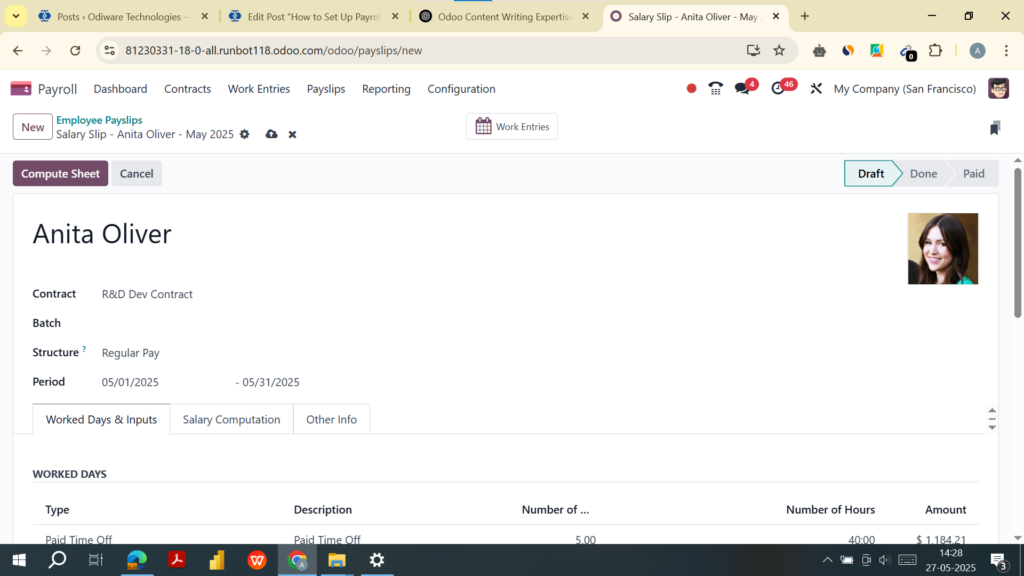

Step 5: Generate Payslips

Path: Payroll → Payslips → Create

- Select an employee.

- Enter:

- Period (start and end date).

- Structure (auto-fetched from contract).

- Click Compute Sheet to preview breakdown.

- Click Confirm to validate the payslip.

- Optionally, click Mark as Paid and Send by Email.

📌 Use “Batch Payslips” for bulk processing:Payroll → Payslips Batches → Create

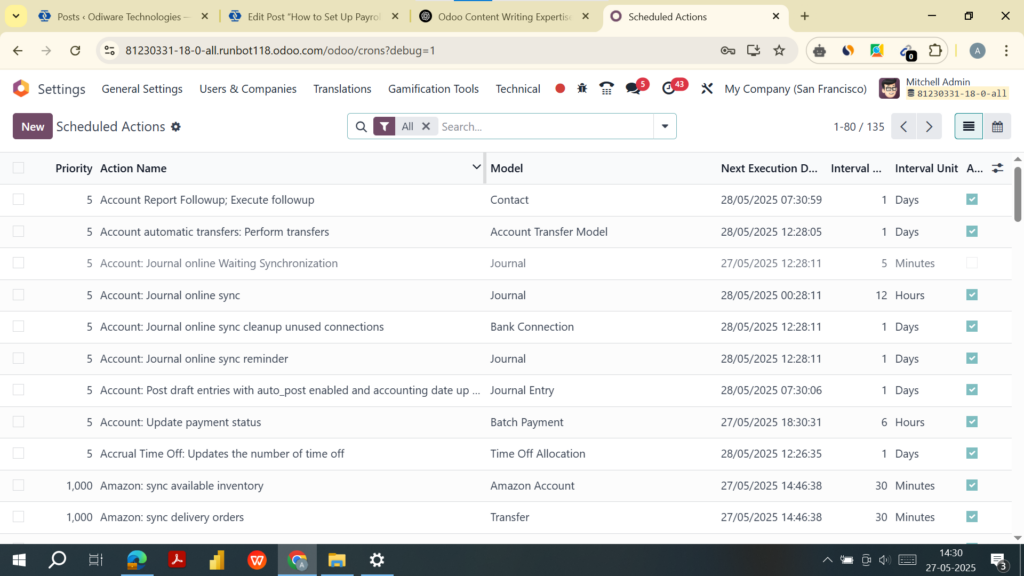

Step 6: Automate Payroll Processing

Enterprise-exclusive features include:

- Scheduled Actions to run payroll monthly:

Settings →On The Developer Mode -> Technical → Automation → Scheduled Actions - Automated Bank File Generation:

- Enable SEPA or use localized bank formats.

- Go to Payroll Settings to enable bank integration.

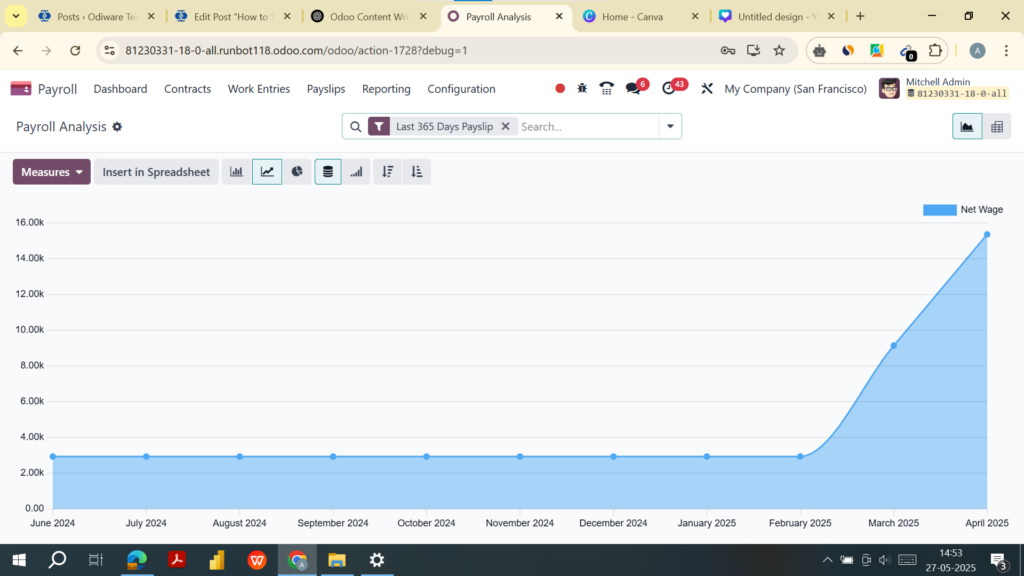

Step 8: Generate Reports

Go to: Payroll → Reporting

Available reports:

- Payroll Summary

- Employee Payslip History

- Deductions Summary

- Tax Reports

- Journal Entries (from Accounting)

Contact Odiware Today

Start streamlining your payroll processes now and experience seamless payroll automation. Contact Odiware Technologies for more information.

- Phone: +91 86608 65440

- Email: sales@odiware.com

- Website: www.odiware.com

Don’t let compliance stress hold your business back. Partner with Odiware and ensure your HR processes are compliant, efficient, and future-ready.

One thought on “How to Set Up Payroll in Odoo HRMS?”

Comments are closed.